Great Southern Bank partners with Reg360 and ElysianNxt to automate its Capital and Credit Risk requirements

Brisbane, 25 August 2022

Reg360, one of Australia’s leading RegTech companies, today announced that it has entered into a partnership with Great Southern Bank to deliver a Cloud-based Capital and Credit Risk Management and Reporting solution. In partnership with ElysianNxt, a Belgium/Thailand-based RiskTech provider, Reg360 will implement an integrated Risk Calculation and Reporting platform as a Software as a Service (SAAS).

In a first phase, the solution will address Great Southern Bank’s requirements under APRA’s revised capital framework for Basel (APS 110 & APS 112) and automate the related APRA reporting requirements, which come into force on 1 January 2023.

“After conducting a formal tender process over the past year, the joint Reg360/ElysianNxt consortium were the clear partner of choice for Great Southern Bank,” said Matt Cammack, Head of Data at Great Southern Bank.” The team at Reg360 and ElysianNxt have the proven expertise to deliver on our business and regulatory requirements and they are well-aligned with our data strategy and technology roadmap. We look forward to implementing their scalable Cloud-hosted platform to deliver on the bank’s current and future Capital and Credit Risk calculation and APRA reporting needs.”

Reg360 delivers a collaboration platform which forms a central system-of-record for enterprise reporting. The solution supports firms to efficiently prepare and submit all regulatory reporting requirements, including granular data sets, in line with APRA’s 5-year roadmap towards “Comprehensive Data Collections”. Reg360 enhances regulatory reporting governance frameworks and enterprise data governance controls over data ownership, data quality and data lineage.

ElysianNxt is one of the world’s leading Risk Vendors, bringing real-time computations and analytics for all risk types into a single solution. Built on a microservices architecture to fully leverage the power of Cloud, Reg360 and ElysianNxt support an ecosystem of API-driven applications that bring a modern, scalable architecture into the Risk and Finance Departments. The revised Capital Framework in Australia requires the combination of Basel IV and IFRS 9 requirements into a single architecture, something ElysianNxt has already proven successfully in other parts of the world.

“The Australian Financial Services industry continues to undergo significant change. Leveraging the power and flexibility of the cloud to deliver applications in Finance and Risk that are designed for change, delivers the best outcomes for our clients” Robert Philipsz, Head of Product at Reg360, said. “Our partnership in Australia with ElysianNxt illustrates that our eco-system approach bears fruit and that collaboration between technology vendors leads to superior solutions for the industry that solve their common challenges. We look forward to continuing our partnership with Great Southern Bank well-beyond APS 112 and APRA reporting compliance.”

About Great Southern Bank

Great Southern Bank is a customer-owned bank based in Brisbane, Queensland, Australia. As of 2013, it is the largest customer-owned financial institution in Australia. It offers banking and insurance services to 420,000 Australians.

About ElysianNxt

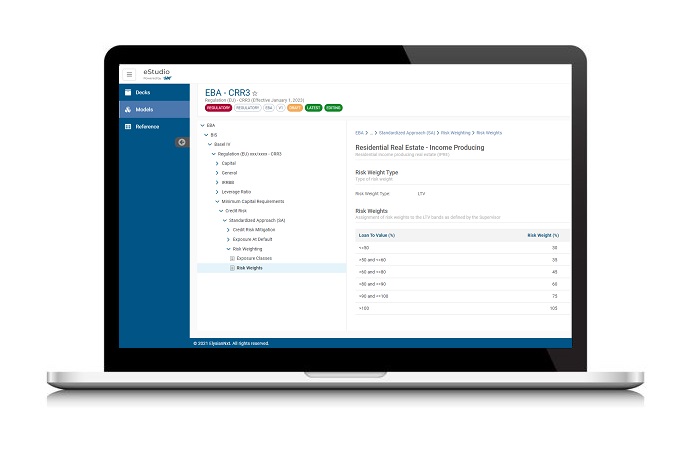

ElysianNxt's Basel and IFRS9 solutions are part of a pioneering, end-to-end Financial Risk platform that was built using the latest streaming technologies. By using a distributed microservices architecture compared to a traditional central-database design, the solution can process large quantities of information in real-time. Users can react quickly to changes by performing real-time stress testing and running multiple simulations on the fly to see the immediate impact in minutes. The user-friendly system interface design provides useful information from the portfolio level, which can be drilled down to the contract level and exported in various formats.

About Reg360

Reg360 provides innovative solutions in Data Management, Finance, Risk Management and Reporting across the industry. The Reg360 team consist of highly experienced technology professionals who are passionate about leveraging technological advancement to drive efficiencies, deliver insight, and ensure regulatory compliance. Solution options allow for all APRA regulated industries to be supported in their governance and workflow of finance, risk prudential reporting and submission requirements whilst being supported by a team of professionals who monitor regulatory updates locally and abroad. The technology and purpose statement received early acclaim with a finalist position awarded by the Saudi G20 technology sprint facilitated by the Bank for International Settlements in 2020.

About us

ElysianNxt is a fast-growing RegTech company focused on developing the most technologically advanced, user-friendly, real-time Risk and Finance solutions. Comprised by seasoned industry veterans and subject matter experts, the company was established to provide an alternative solution to the traditional, outdated, monolithic applications that the financial industry is accustomed to in their quest to automate their back-end financial calculation obligations.

Contact Information

BELGIUM

Koning Albert II-laan 7, 1210 Brussels, Belgium

+32 470 41 42 62

THAILAND

29/1 Piya Place Building, Tower B, 11th Floor Unit 11E, Langsuan, Ploenchit Road, Lumpini, Pathumwan, Bangkok 10330, Thailand

+66 2 255 2281

Contact Information

INDONESIA

Equity Tower, 49th Fl., Unit B, C, F Jl. Jendral Sudirman Kav. 52-53, SCBD District Centre, Jakarta Selatan 12190, Indonesia

+62 21 2965 1260