IMB goes live with Reg360 and ElysianNxt to automate its Capital and Credit Risk Reporting

15 May 2023

Reg360, one of Australia’s leading RegTech companies, today announced the successful implementation and delivery of a cloud-based Capital and Credit Risk Management and Reporting solution for IMB. In partnership with ElysianNxt, a Belgian/Thai-based RiskTech provider, Reg360 has implemented an integrated Risk Calculation and Reporting platform as a Software as a Service (SaaS).

The solution has provided the bank valuable insights into the impact of the Basel changes into their portfolio when it was utilized as part of the Quantitative Impact Study (QIS) in 2021 and 2022. Since then, the solution has addressed IMB’s requirements under APRA’s revised capital framework for Basel (APS 110 & APS112) and automated the related APRA reporting requirements, which came into force on 1 January 2023.

“After a successful relationship held with this consortium over the past years, the joint Reg360/ElysianNxt team have been the clear partner of choice for IMB,” said Chris Goodwin, CFO at IMB. “The team at Reg360 and ElysianNxt have provided their expertise and support to meet our business and regulatory objectives. We are very satisfied with the professional project delivery and look forward to expanding the use of the system to other areas of our business.”

IMB is in the process of planning the next phase of the project to expand the use of the application to other areas of the business and the wider APRA regulatory reporting requirements

“The flexibility and speed in which our applications were able to produce results which enabled IMB to gain valuable insights during the QIS and go live with an automated reporting for Credit Risk is a true testament of the effectivity of the combined solutions.” said Piet Mandeville, Risk Product Manager at ElysianNxt. “We look forward to continuing our partnership with IMB as they expand the use of the application.”

“Our partnership in Australia with ElysianNxt illustrates that our eco-system approach bears fruit and that collaboration between technology vendors leads to superior solutions for the industry that solve their common challenges.” Said Robert Philipz, Product Manager for Reg360. “We look forward to continuing our partnership with IMB well-beyond APS 112 and APRA reporting compliance."

Reg360 delivers a collaboration platform which forms a central system-of-record for enterprise reporting. The solution supports firms to efficiently prepare and submit all regulatory reporting requirements, including granular data sets, in line with APRA’s 5-year roadmap towards

“Comprehensive Data Collections”. Reg360 enhances regulatory reporting governance frameworks

and enterprise data governance controls over data ownership, data quality and data lineage.

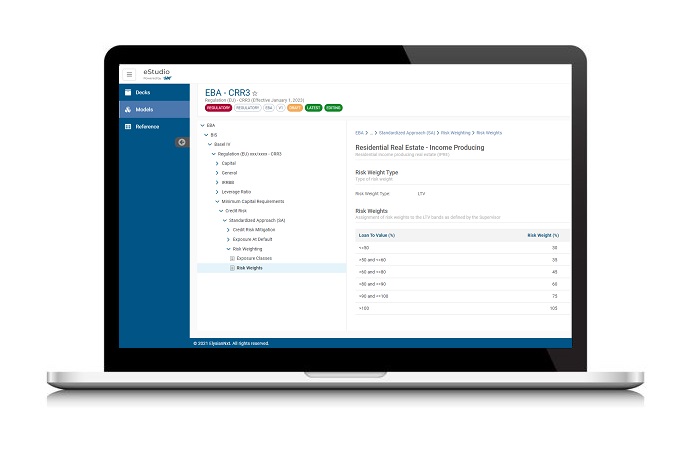

ElysianNxt is one of the world’s leading Risk Vendors, bringing real-time computations and analytics for all risk types into a single solution. Built on a microservices architecture to fully leverage the power of Cloud, Reg360 and ElysianNxt support an ecosystem of API-driven applications that bring a modern, scalable architecture into the Risk and Finance Departments. The revised Capital Framework in Australia requires the combination of Basel IV and IFRS 9 requirements into a single architecture, something ElysianNxt has already proven successfully in other parts of the world.

About IMB Bank

Established in 1880, IMB have been helping people achieve their financial goals for over 142 years. IMB is an innovative bank, with extensive digital banking and options for when you need to speak with a friendly face in person, in a branch or in your home. Bank members have access to a fully featured range of banking services home and personal lending, savings and transaction accounts, term deposits, business banking, and can arrange financial planning, and insurance and travel products.

About ElysianNxt

ElysianNxt's Basel and IFRS9 solutions are part of a pioneering, end-to-end Financial Risk platform that was built using the latest streaming technologies. By using a distributed microservices architecture compared to a traditional central-database design, the solution can process large quantities of information in real-time. Users can react quickly to changes by performing real-time stress testing and running multiple simulations on the fly to see the immediate impact in minutes. The user-friendly system interface design provides useful information from the portfolio level, which can be drilled down to the contract level and exported in various formats.

About Reg360

Reg360 provides innovative solutions in Data Management, Finance, Risk Management and Reporting across the industry. The Reg360 team consist of highly experienced technology professionals who are passionate about leveraging technological advancement to drive efficiencies, deliver insight, and ensure regulatory compliance. Solution options allow for all APRA regulated industries to be supported in their governance and workflow of finance, risk prudential reporting and submission requirements whilst being supported by a team of professionals who monitor regulatory updates locally and abroad. The technology and purpose statement received early acclaim with a finalist position awarded by the Saudi G20 technology sprint facilitated by the Bank for International Settlements in 2020.

About us

ElysianNxt is a fast-growing RegTech company focused on developing the most technologically advanced, user-friendly, real-time Risk and Finance solutions. Comprised by seasoned industry veterans and subject matter experts, the company was established to provide an alternative solution to the traditional, outdated, monolithic applications that the financial industry is accustomed to in their quest to automate their back-end financial calculation obligations.

Contact Information

BELGIUM

Cantersteen 47, 1000 Brussels, Belgium

+32 2 896 58 71

THAILAND

29/1 Piya Place Building, Tower B, 11th Floor Unit 11E, Langsuan, Ploenchit Road, Lumpini, Pathumwan, Bangkok 10330, Thailand

+66 2 255 2281

Contact Information

INDONESIA

Menara BCA 50Fl, Grand Regus 5016-5017, Jl. M.H. Thamrin No. 1, Jakarta, Jakarta 10310, Indonesia

+62 21 2965 1260